Invest Like a Few. Prosper Like None!

Alternative investments, redefined—where global access meets Indian expertise.

About Us

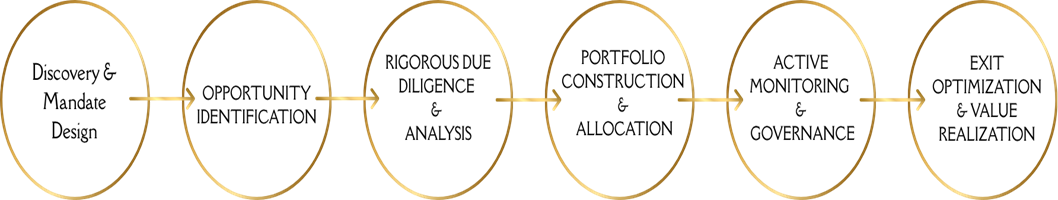

Fiducrest is a next-generation fund house and advisory platform built for the discerning investor. Operating from GIFT City—India’s premier international financial center—we specialize in architecting bespoke investment journeys through globally compliant AIFs, Pooled Funds, and SMAs. Our approach blends global access with deep local intelligence, tax efficiency, and regulatory clarity. We don’t pitch products; we build partnerships founded on trust, discipline, and long-term alignment. Backed by integrity, insight, and innovation, Fiducrest empowers investors who seek more than performance—they seek precision.

Global Access, Local Expertise

With the flexibility of foreign currency investing, tax neutrality, and regulatory agility through GIFT City, we empower clients to unlock opportunities across borders- confidently and compliantly.

Professional Integrity

At Fiducrest, every decision is grounded in research, ethics, and alignment with client goals. We don’t follow fads – we follow fundamentals.

Tailored Investment Models

We offer a spectrum of fund structures from diversified growth-focused AIFs to fully customized SMAs, catering to varied invertor preferences, sectors, and risk profiles.

Our Philosophy

Conviction, Stewardship, Long-Term Value

Your capital deserves more than momentum—it deserves a strategy. At Fiducrest, we grow it with care and conviction.

Our Services

Pooled Funds

Pooled Funds at Fiducrest are structured under our Category II AIF platform, offering investors access to curated portfolios across private equity, credit, infrastructure, and special situations. By aggregating capital from multiple investors into a single fund, we deliver broad diversification, institutional-grade diligence, and strategic deployment—without requiring direct involvement from each investor.

Separately Managed Accounts (SMAs)

SMAs at Fiducrest are built for investors who seek precision, privacy, and portfolio-level customization. Unlike pooled funds, SMAs offer a fully personalized investment structure—crafted around the investor’s specific goals, risk appetite, sector preferences, and liquidity needs. Each SMA operates as a dedicated fund vehicle, providing direct visibility, bespoke reporting, and strategic flexibility across asset classes like private equity, credit, infrastructure, and special situations